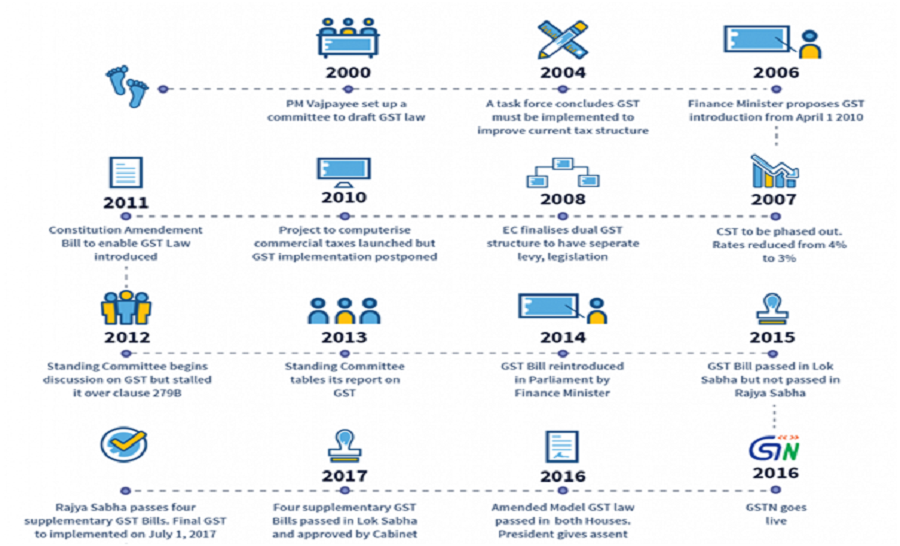

HISTORY OF GST IN INDIA

GST was introduced to replace multiple indirect taxes, which were existing under previous tax regime. This is a single tax rate for goods and service for whole of India. Tax compliance is also better as taxpayers are not bogged down with multiple return forms and deadlines for various states.

Now, the question arises what are the components of GST

There are three taxes applicable under GST. CGST, SGST & IGST.

CGST: It is the tax collected by the Central Government on an intra-state sale (e.g., a transaction happening within Delhi).

SGST: It is the tax collected by the State Government on an intra-state sale (e.g., a transaction happening within Delhi).

IGST: It is the tax collected by the Central Government on an inter-state sale (e.g., a transaction happening from Delhi to Maharashtra).

Who are the persons required to apply for GST Registration

• Casual taxable persons.

• Non-resident casual taxable persons.

• Persons making any inter-state taxable supplies.

• Agents acting on behalf of a registered taxpayer.

• E-commerce operators.

• TDS/TCS deductor.

• Persons conducting business in a state other than the one they are located in.

• Persons who sell products on e-commerce sites such as Amazon and Flipkart.

• Individuals working in the import-export industry.

• Persons subject to reverse charge taxation.

• Businesses registered under previous taxes such as VAT, excise, and service tax.

• Individuals running an aggregator company.

• Input Service Distributors.

• OIDAR (Online Information Database Access and Retrieval) service providers in India.

Who are the persons not required to apply for GST Registration

• Non-taxable goods like petrol and alcohol for human consumption are not subject to GST.

• Goods supplied to SEZ developers, or Special Economic Zones fall under the GST exemption list.

• Items included in the zero-rated list, meaning that their fixed tax rate is zero percent, are free from GST.

• Transport facilities such as public transport, metered cabs, auto-rickshaws, metro, etc.

• Shipping of farm produce and goods outside of India.

• Transportation of goods where the total cost is less than Rs. 1500.

• Governmental and foreign diplomatic services.

What are the various GST Forms that needs to be filed

• GSTR 1 (have option to file monthly and quarterly i.e. IFF)

• GSTR 3B

• CMP-08

• GSTR 4

• GSTR 5

• GSTR 5A

• GSTR 6

• GSTR 7

• GSTR 8

• GSTR 9

• GSTR 9C

• GSTR 10

• GSTR 11

• ITC 04